Want to grow your savings without working extra hours? Passive income is the key! Whether you’re saving for emergencies, a dream vacation, or retirement, these smart passive income ideas can help you earn money with minimal ongoing effort. Let’s explore proven strategies that fit different budgets and skillsets.

A clean, modern image (630px × 1200px) with a light background, a piggy bank or upward-trending graph, and bold text: “Smart Passive Income Ideas to Boost Your Savings” in a readable font (e.g., Montserrat or Poppins). Avoid clutter—keep it simple and motivational.

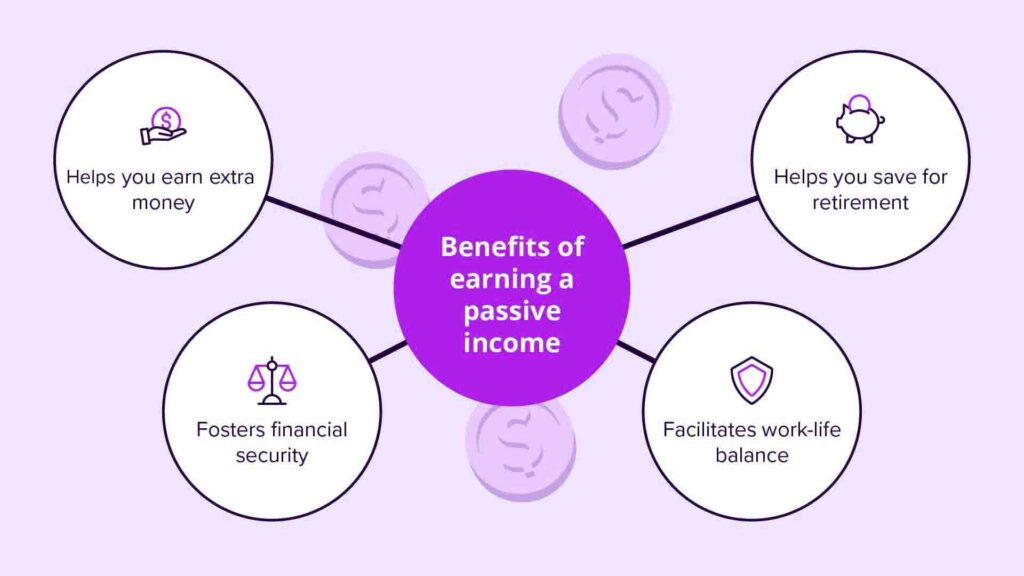

Why Passive Income Matters

Passive income streams generate money while you sleep, reducing reliance on a single paycheck. They’re ideal for:

- Busy professionals who want extra cash flow.

- Freelancers looking to diversify income.

- Long-term savers building financial security.

7 Smart Passive Income Ideas to Try Today

1. Invest in Dividend Stocks

How it works: Buy shares of companies that pay regular dividends (e.g., Coca-Cola, Johnson & Johnson). You earn a share of profits without selling the stock.

Tips: Reinvest dividends for compound growth. Use apps like Robinhood or M1 Finance for easy investing.

2. Rent Out Unused Space

Options:

- List a spare room on Airbnb.

- Rent out storage space via Neighbor.

- Lease your parking spot with SpotHero.

Bonus: Minimal effort after setup!

3. Create a Digital Product

Examples:

- E-books (Amazon Kindle Direct Publishing).

- Printable planners (Etsy).

- Online courses (Udemy, Teachable).

Pro Tip: Repurpose content from your expertise (e.g., “Budgeting for Beginners”).

4. Peer-to-Peer Lending

Platforms: LendingClub, Prosper.

Loan money to individuals or small businesses and earn interest (typically 5–10% annually).

Risk: Diversify loans to minimize defaults.

5. Affiliate Marketing

Promote products (Amazon Associates, ShareASale) and earn commissions for sales.

Low-effort method: Add affiliate links to a blog, YouTube video, or social media bio.

6. High-Yield Savings Accounts & CDs

Where: Online banks like Ally or Marcus offer 4–5% APY (vs. 0.1% at traditional banks).

CDs: Lock in higher rates for 6–60 months (penalties for early withdrawal).

7. Automated Dropshipping

How: Sell products via Shopify without handling inventory. Suppliers ship directly to customers.

Key: Use tools like Oberlo and focus on niche products (e.g., eco-friendly gadgets).

How to Start Earning Passive Income

- Pick 1–2 ideas that match your budget/skills.

- Set up systems (e.g., automate investments).

- Track progress monthly.

Building passive income takes initial effort, but the long-term payoff is worth it. Start small, stay consistent, and watch your savings grow!